01 Aug Betriebskosten or Nebenkosten. What is understood by service charges for apartments in Austria?

When expatriates rent an apartment in Austria for the first time, they often do not know what utilities are, what they include, and how they are calculated. Only a small percentage of newcomers are assisted by a relocation service that can guide them through the hurdles of renting an apartment in a foreign country with foreign laws so that they can glide through the move without any unpleasant surprises.

What are the utility or operating costs of a rental property?

The short answer: Operating expenses include all service costs incurred to keep a building operating properly.

The Tenancy Act regulates exactly what service charges are and how they can be charged.

TENANTS CAN ONLY BE CHARGED FOR THE FOLLOWING COSTS:

- Cold and warm water charges

- The cost of regular chimney sweeping

- Sewer fees

- Costs of pest control and garbage collection

- Costs of general house lighting

- Costs of house maintenance (cleaning)

- Costs of building insurance against fire, storm and water damage

- Costs of legal liability insurance

- Costs of house management

- Costs for the operation of common facilities (e.g. laundry, sauna, swimming pool, elevator, common heating system).

Other items may not be included in the statement of operating expenses. Costs for repair and maintenance work (e.g. roof, elevator, entrance gate) or handling, booking or computer fees may not be charged to the tenants as operating costs.

EACH POINT IN DETAIL

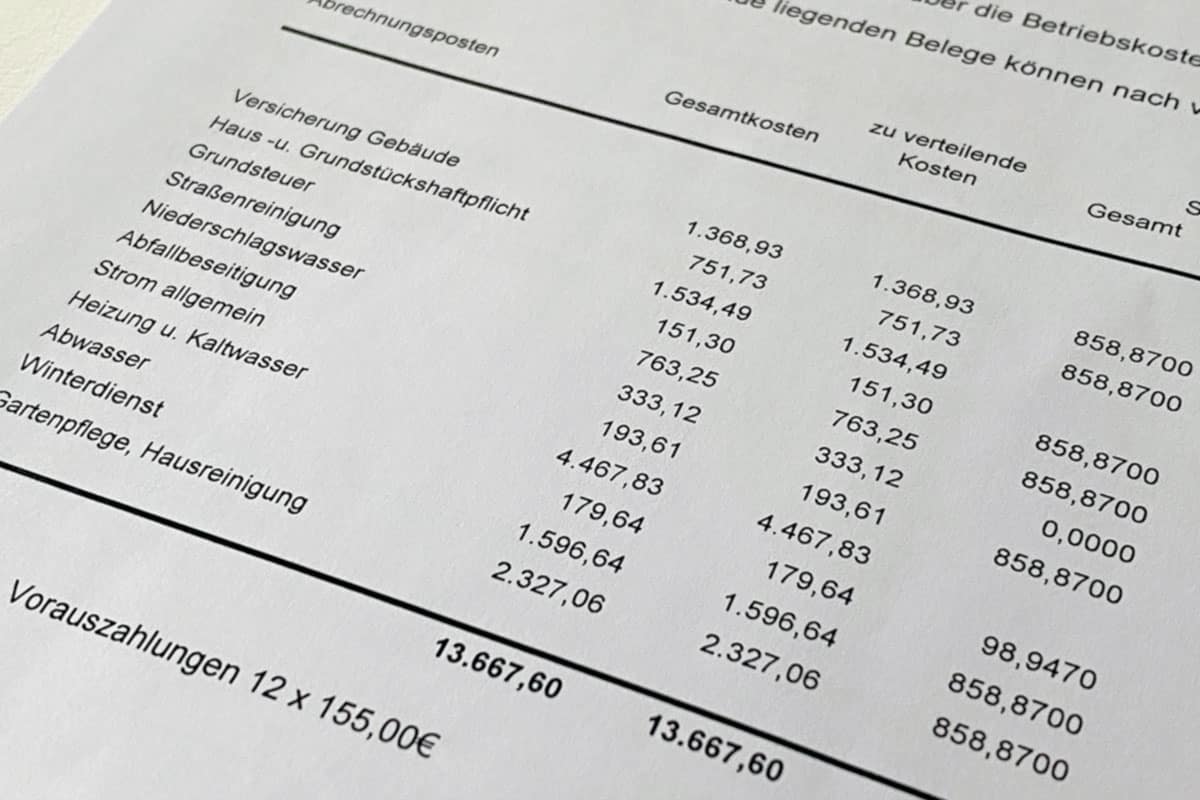

Billing Operating Costs

In most cases, a monthly flat fee for operating expenses will be charged and any additional operating expenses, should they arise, will be billed once a year. The statement of operating expenses must be submitted by the landlord no later than June 30 of the following year. The tenant may request a copy of the invoices up to six months after the statement is submitted.

Operating expenses must be settled within one year of the end of the fiscal year. After this one-year period, the landlord cannot make any additional claims against the tenant.

If the settlement of yearly expenses results in a credit or debit, the additional payment or refund will be due with the next-but-one rental payment.

Billing Review

It is possible to review operating expenses going back the last 3 years.

A review may be requested from the arbitration board or the district court if there is any doubt as to the accuracy of the statement of operating expenses. Similarly, if the landlord refuses to provide this statement, the arbitration board or district court may be asked to allow inspection of the statement and invoices or to provide copies of the invoices.

Change of Tenant

If there is a change of tenant, the tenant who leaves the apartment cannot be charged with the payment of arrears of operating charges at a later date. Unless otherwise agreed in the contract, the subsequent tenant who is the tenant on the next-but-one payment date after the operating costs statement has been prepared is responsible for the subsequent payment.

Regulation of operating costs in the Lease Agreement

The provisions of the Tenancy Act (MRG) on operating costs do not apply to many rental properties. This affects, for example, apartments in privately financed new buildings or in detached and semi-detached houses. The law does not specify which costs may be charged as operating costs and how they are to be settled. The agreements in the lease are decisive.

Missing or ineffective operating cost agreements in the lease cannot be charged to the tenant.

Operating expenses are divided up as follows:

WATER COSTS

- The cost of supplying water to the house

- The cost of controlling the water supply in accordance with the regulations.

but not:

- Water and sewer connection costs

- Cost of repairing burst pipes

- Cost of replacing riser pipes

If there is a professional establishment (e.g. restaurant, doctor’s office) in the building, which both currently and permanently consumes a disproportionately high amount of water compared to the other rental objects, it has to bear the costs of this additional consumption alone. This means that, in these cases, the principle of dividing the operating costs according to the respective floor area of the individual rental objects is not applied. In practice, a separate water meter is installed for the commercial premises in such cases.

CHIMNEY SWEEPING

- Recurring expenses for chimney sweeping, if required by chimney sweeping regulations.

- A deep chimney cleaning (which requires specialist materials to remove solidified dirt, soot, and grime) is not considered an operating expense.

SEWER CLEANING

WASTE DISPOSAL

- Costs of garbage removal

- Costs of clear-outs, such as removing all waste from cellars

However, in the case of junk removal, only the costs necessary to remove items whose origin can no longer be determined may be charged as an operating expense to all tenants in the building. Therefore, if items are removed that can be traced back to individual tenants or the property owner, those costs cannot be charged as an operating expense.

PEST CONTROL

(Such as rat extermination)

LIGHTING

- General lighting costs: This includes the cost of electricity for the stairwell and the cost of replacing light bulbs and fuses. The cost of repairing damage to electrical wiring is not considered an operating expense.

FIRE INSURANCE

- Adequately insuring the building against fire damage, provided that the insurance costs are equal to the expense necessary to restore the home in the event of fire damage.

LIABILITY INSURANCE AND INSURANCE AGAINST DAMAGE CAUSED BY TAP WATER.

- Adequate insurance coverage of the home against the homeowner’s legal liability and against tap water damage, including corrosion damage.

ADEQUATE INSURANCE COVERAGE OF THE BUILDING AGAINST OTHER DAMAGE.

- Such as glass breakage or storm damage. However, such expenses may be charged only if the majority of the Principal Tenants, calculated by number of rental units, have approved the purchase, renewal or amendment of the insurance policy.

EXPENSES FOR THE ADMINISTRATION OF THE BUILDING

- This includes expenses for printed materials, reservation fees and similar (lease establishment costs etc.): For this purpose, an amount equal to the applicable Category A rent may be charged per calendar year and per square meter of usable floor area of the building. This applies regardless of whether the actual costs of managing the property are higher or lower than this flat rate and regardless of whether the property is managed by the owner themselves or by a professional property manager.

EXPENSES FOR HOUSE CLEANING

PROPORTIONAL PUBLIC TAX PROVISIONS

- In addition to the dues and charges that may be passed on under state law, the only public charges that may be passed on are property taxes.

THE COST OF OPERATING THE COMMUNAL FACILITIES (IF ANY):

- These are the costs of a communal heat supply (heating and hot water, if applicable, according to the special regulations of the Heating Costs Settlement Act), as well as the costs of other communal facilities, such as communal laundry facilities, an elevator, and garden maintenance, provided that these facilities are available to all tenants. If a common facility is not available to all tenants, the costs are allocated only to those who are able to use and access the facility in question. This is the case, for example, with an elevator if only the tenants on the upper floors use it with their own keys.

Specifically, operating costs do not include:

- Repair and maintenance costs

- Additional insurance, such as windstorm, glass breakage, or hail, if purchased without the consent of the majority of tenants

- Postage or bank charges

- Chimney maintenance costs

- Cleaning costs for items that provably belong to the landlord or individual tenants

- Additional costs due to an incorrect distribution key

- “Other”

Allocation of the operating costs according to rental law (operating cost key)

Unless otherwise agreed in writing between the Landlord and all Tenants of the Building, the contribution of a Leasehold Premises to the total operating expenses of the building shall be based on the ratio of the usable floor area of such Leasehold Premises to the total usable floor area of the building.

The total usable area of the building shall be calculated as the sum of the usable area of all rented leasehold premises and the usable area of the leasehold premises not rented by the Landlord, although they are rentable. The Landlord shall therefore bear the pro rata operating costs for the vacant but rentable premises.

Any tenant may request a review of the operating cost formula at the district court.

(in Linz, this can be requested from the Arbitration board).

Settlement of operating costs according to rental law

The Landlord shall prepare a statement of operating expenses no later than June 30 of the following calendar year. The statement of operating expenses must be available for inspection in the building manager’s office or another appropriate place in the building. In addition, the Landlord shall permit the inspection of the invoices accompanying the statement or, if the invoices were provided digitally, printouts of the invoices and, at the request of the Tenant, have copies made of the statement and the invoices at the Tenant’s expense.

If the Landlord does not comply with the obligation to provide the statement or to inspect the receipts, any tenant may file a complaint with the competent district court or with the Arbitration board.

Settlement – credit note or subsequent payment.

CREDIT BALANCE

If the annual statement results in a credit balance, the landlord must repay the credit balance on the next-but-one interest payment date following the compilation of the annual statement (e.g. if the statement is issued on April 25, the credit balance is due on June 1).

ADDITIONAL CLAIM

If the statement results in an additional claim, this is also due on the next-but-one interest payment date after the statement.

The tenant who is entitled to the credit or who is obliged to make an additional payment is the tenant on the due date (next-but-one interest payment date after the statement), regardless of whether this person was already a tenant during the entire year the statement applies to, or only moved in during the year in question.

Verification of operating costs

The only way to verify the final total of the operating expenses is to review the receipts and invoices provided by the landlord.

As a tenant, you have the right to inspect these invoices. It must be possible to inspect the invoices without great effort and within a reasonable period of time. The place and time of the inspection must be noted on the statement.

The collection of receipts and invoices must be kept clearly arranged and these documents must be marked in such a way that they can be easily found in the collection of all receipts. The main tenant is entitled to receive copies of the statement or receipts only if he/she pays for the copies and only in connection with the submission of the statement. This means that these documents can be inspected until 31.12. of the year in which the statement was properly prepared.

Within the framework of the Tenancy Act, any tenant may apply to the competent district court for a review of the statement of operating costs. In this context, a request can be made to determine whether certain items included in the statement are operating costs at all and, if so, whether the amounts charged are justified.

ATTENTION

Operating cost statements from within the last 3 years can be reviewed.

The situation is different for cooperative housing blocks: Here, the statement is considered accepted if no objection is raised with the landlord within 6 months of issue.

In conclusion, I hope that this article will help tenants and landlords to get rid of misunderstandings and enable the basis for a good and fair relationship between both parties.

We will be very happy to help you if, despite all our efforts, any unanswered questions remain. We will gladly inform you without obligation.

Sincerely,

Your Sista

Sorry, the comment form is closed at this time.